I typically have been a bottom up investor- look for companies I think are undervalued, and invest in the hope that others will see the bargain out there and raise the price. This is called ‘Bottom up Investing‘, focusing on the individual market vs the stock sector or the asset class.

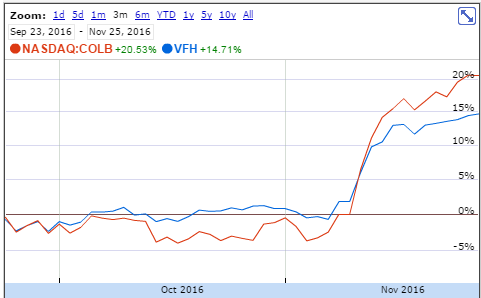

However, the market action of the last month has shaken my belief that bottom up investing is rational. Since the Presidential Election, stocks in the Financial and Industrial sectors have taken off, on really no fundamental news. For example, take a look at Columbia Banking (COLB) and the Vanguard Financial ETF (VFS) over the last 3 months:

No news, no management changes, just a lot of stock being pumped into the financial sector because of the new administration.

Here is another example, FLIR Systems (FLIR) systems, in the industials sector, compared to the Vanguard Industrials ETF (VIS):

Again, no news, just happens to be in a sector where money managers are moving money too. FLIR Systems has a number of industrial products centered around imaging and surveillance cameras – I hope this doesn’t reflect a belief that this administration is going to ramp up spending on domestic surveillance, but this isn’t a positive sign.

And what caused this huge shift in sector allocation? My best guess is Trumps leaning towards rebuilding infrastructure and piling up bigger government debts. That’s a lot of money moving around based on an administration whose policies are murky at best.

So, should I abandon bottom up investing and switch to top down investing? No. I won’t abandon it – I cling to the belief that undervalued companies will be recognized eventually. However, I do think I need to increase my focus on watching asset class and sector indicators. It does appear in this world where so much money is managed by a small pool of investors, there is is something to watching what the so called ‘smart money’ finds attractive.