I finally broke down and bought some crypto currency. While I was never in the camp that crypto was a fad, I was never a believer enough to actually buy any. What finally tipped the scale for me was seeing all this big money going into bitcoin. More and more big Wall Street money managers are hedging using crypto, and soon you will see ETF’s available which will make it much more easy to buy and liquid. So finally, I bought a tiny enough so at least I can get a better feel for where crypto fits in my investment portfolio.

First I had to decide on a crypto coin. I finally decided to buy Ethereum – not Bitcoin.

I bought Ethereum not because I know what I am doing, I just weighed a few factors:

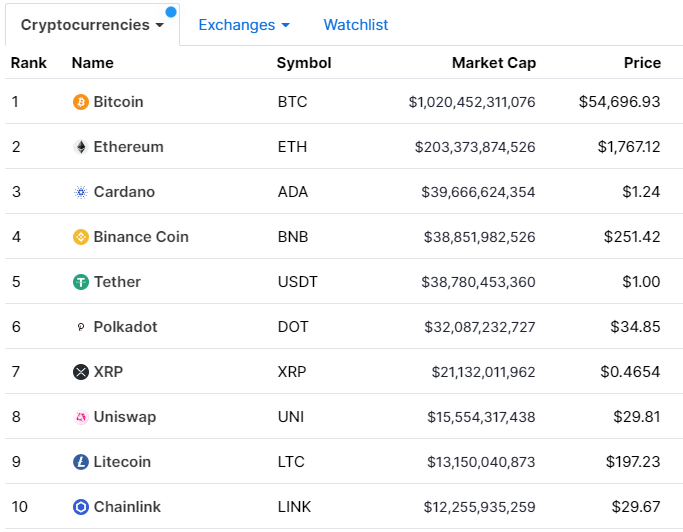

- First, I wanted a coin with one of the top market caps. There are a zillion different crypto currencies, and the only ones that are valuable are the ones that people think are valuable. The bigger a market cap gets, the more it represents trust. Here is a chart of the top 10 cryptos ranked by Market Cap:

- Second, I noticed that non-fungible tokens (NFT)’s primarily trade in Ethereum. Now that NFT’s are here – crypto currencies are starting to look pretty mainstream. I am not a believer in NFT’s enough to consider buying any, but I do think its an interesting concept – more on that in a future post.

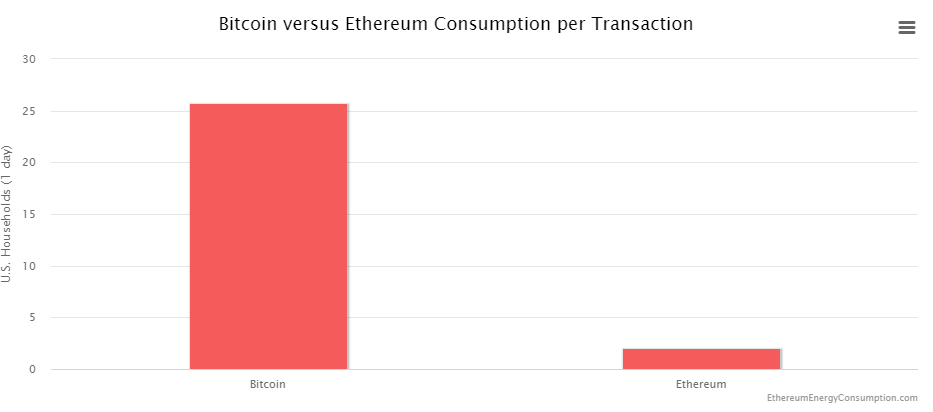

- Bitcoin gets a bad rap because of the energy it takes to process transactions, and indeed it is much more energy heavy:

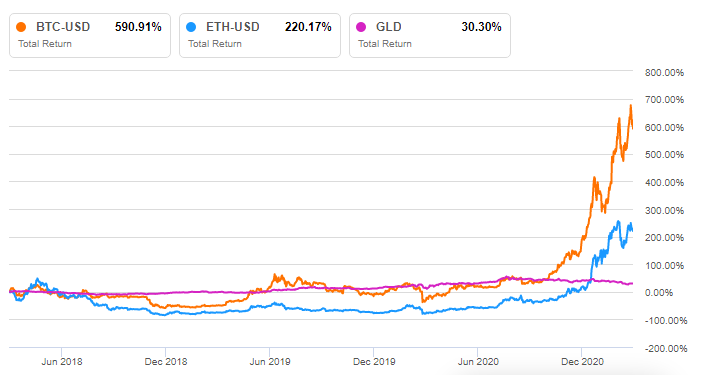

I assume if Ethereum reaches the scale of bitcoin the energy usage will rise to match, but Ethereum does have on its technology roadmap a plan to make it much more energy efficient. While Ethereum has not performed as well as Bitcoin as seen by the chart above, it tracks it close enough for me until I have a better idea of what my strategy is.

Note also from the chart above how both Bitcoin and Ethereum have performed as compared with Gold (GLD). One would think Gold would somewhat match the chart of crypto, but it really hasn’t. I have a small amount of gold stocks I own as a hedge on the stock market. I can foresee wanting to use Crypto as a hedge on my gold hedge. I can easily see the rise of crypto and NFT’s as negatively hurting the price of gold. While crypto and NFT’s have no intrinsic value – gold is only a physical representation of an asset that has little intrinsic value. Its a complicated world.

As far as how I bought my Ethereum, I decided to go the easy way and buy it through PayPal – it was a very simple transaction. Crypto purists would say you really want to have your own wallet and store it off the grid, but I have such a tiny amount its not worth the hassle at this point. I guess if the apocalypse comes and we are bartering crypto currency, I may regret that decision.

For now, I am pretty much in watch and learn mode. This is a crazy investing world of late, and the inflow of the younger generations into investing is really challenging some long time strategies. Crypto may just be a bubble investment, or it might be the start of something big. Only time will tell.