I was asked today if I had to pick one stock to buy today, what would I pick. Scanning through my list on Puget Investor, I decided on SodaStream (SODA). Every stock is pretty much a guess about future results, but I think SODA has more chances to succeed than fail.

Lets look at some numbers and charts to help me make my case. Here is an interesting table that was included in SodaStream’s 1st Quarter 2014 results. When these results were announced, the SodaStream stock price took a big hit because net revenue growth was slowing and revenue declined:

| Product Segment Revenue Breakdown |

|

|

|

|

|

|

|

|

| Revenue |

Three Months Ended |

|

|

|

|

|

March 31, 2013 |

|

March 31, 2014 |

|

Increase |

|

Increase |

|

In millions USD |

|

% |

| Soda Maker Starter Kits |

$ |

43.0 |

|

$ |

32.2 |

|

$ |

(10.8) |

|

(25%) |

| Consumables |

|

72.0 |

|

|

83.0 |

|

|

11.0 |

|

15% |

| Other |

|

2.6 |

|

|

3.0 |

|

|

0.4 |

|

15% |

| Total |

$ |

117.6 |

|

$ |

118.2 |

|

$ |

0.6 |

|

0.5% |

|

|

| Product Segment Unit Breakdown |

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

|

|

|

|

March 31, 2013 |

|

March 31, 2014 |

|

Increase |

|

Increase |

|

In thousands |

|

% |

| Soda Maker Starter Kits |

|

776 |

|

|

604 |

|

|

(172) |

|

(22%) |

| CO2 Refills |

|

4,756 |

|

|

5,820 |

|

|

1,064 |

|

22% |

| Flavors |

|

7,735 |

|

|

8,405 |

|

|

670 |

|

9% |

What stands out to me is CO2 refills are up 22% – which means people use their SodaStream machines pretty consistently. They have engaged their customers and get pretty good repeat business.

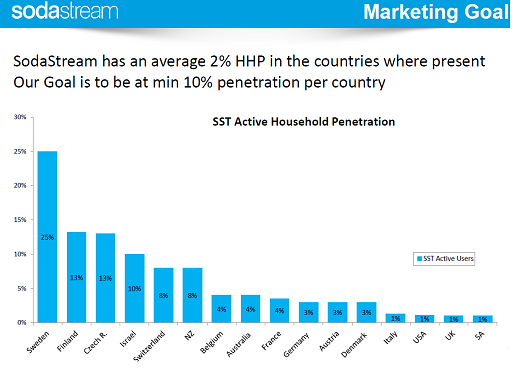

So lots of repeat customers, and still lots of room for growth:

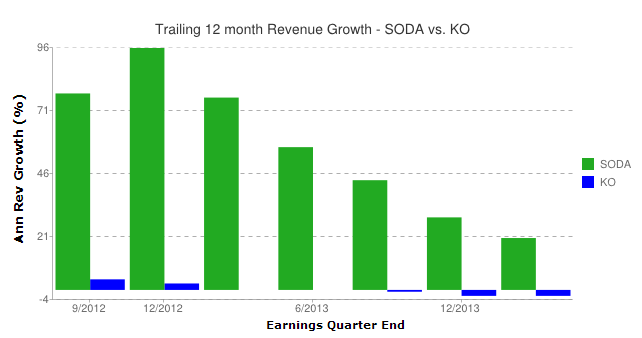

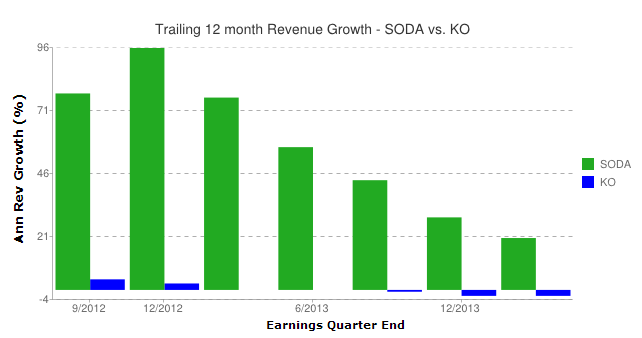

Current US penetration about 1% – and 10% doesn’t seem impossible. However, revenue growth has been slowing for the past few quarters. Below is a chart comparing recent SodaStream growth to Coca-Cola (KO):

I think revenue growth for Soda still has the potential to shrink, but I have faith that growth in new markets and related CO2 refills will help keep growth healthy. In its earnings report, the company provided guidance that it expected revenue growth for 2014 to be approximately 15%.

Coca Cola, with its revenue growth shrinking, has taken a stake in SodaStream competitor Keurig Green Mountain. This is mainly seen as a positive, as Coca Cola has validated the concept of the in home soda machine concept. Over the last few months rumors have arisen that Pepsi or Starbucks were interested in taking a stake in SodaStream, which would be a positive for the stock price. If Coca-Cola is right, and the in-home soda market is an underserved market, Pepsi, Dr Pepper or Starbucks would want to be in that market and be looking for a partner. One other item of interest is that SodaStream would likely compare favorably cost-wise to a K-cup based product that might come out of the Coca-Cola partnership.

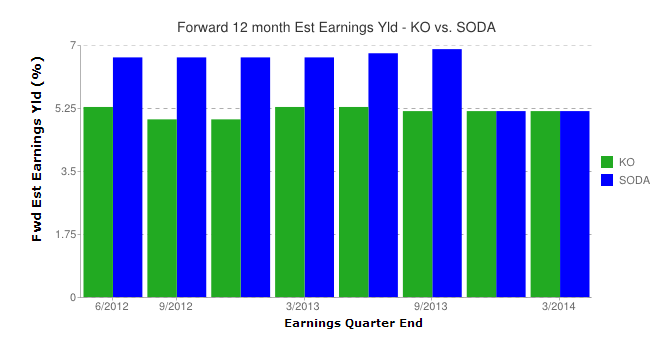

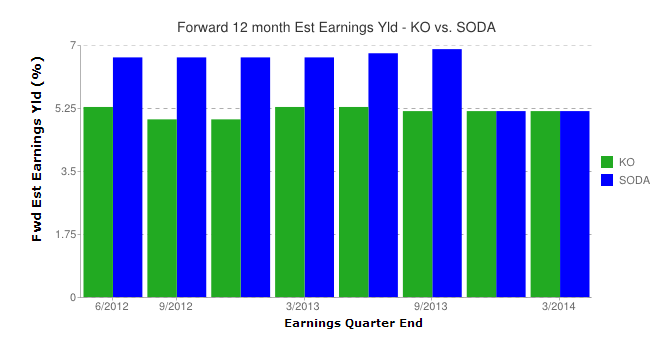

One final point. SodaStream is pretty cheap. Lets look at estimated forward 12 month earnings yield as compared to Coca Cola:

On a 12 month forward earnings basis, Coca Cola and SodaStream are evenly priced. Coca-Cola has the benefit of stability and larger market cap, but Soda stream is growing 15% a year compared to Coca Cola’s flat growth.

The downside for SodaStream? Keurig could come out with a superior soda maker, or the in-home soda making concept could be a fad and die out quickly, or management could make some wrong moves. All stocks have a bull case and a bear case – its up to the investor to figure out which side of the fence to be on. Given the recent sales numbers and the low price, I think Sodastream has the best risk reward ratio of all the stocks I follow.