In September the financial world was on pins and needles as to whether or not the Fed would raise rates by a quarter of a percent. In the end, the Fed did not take the much anticipated step of increasing the benchmark rate due to global risks. At the time, the Chinese economy and stock market was plummeting, so the Fed backed off due to this uncertainty.

Now the market is starting to buzz about a rate hike in December. Minutes from the October Fed meeting have traders thinking the Fed will do a December rate hike. The latest job report tells us that the job market is at full employment. We are nearing perhaps the best of all possible economic worlds, yet I think the Fed will still leave rates at historic lows so as to not risk slowing growth.

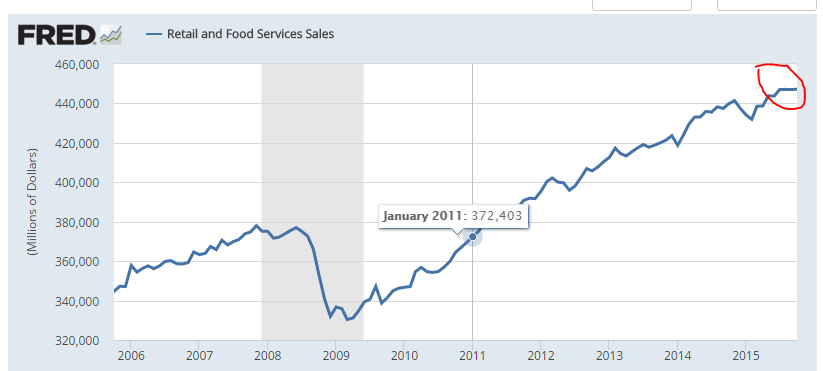

Why? A couple reasons. The latest Retail Sales numbers show the consumer is not spending all this supposed wealth:

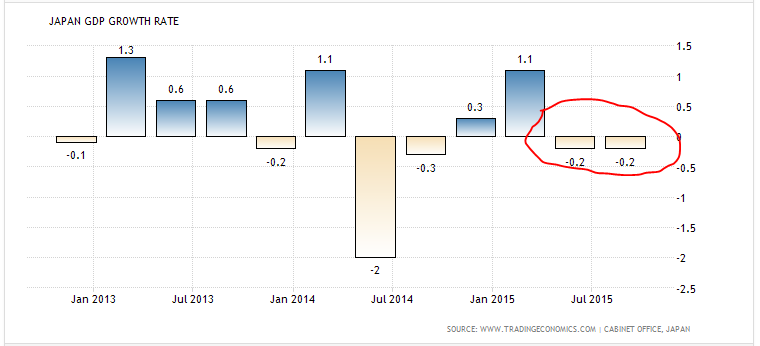

Second, despite the massive fiscal stimulus modeled after the US strategy, Japan – the worlds third largest economy – fell into recession:

(source: http://www.tradingeconomics.com/japan/gdp-growth)

So even though China appears to have stabilized, I think these new economic data points will be enough for the Fed to not do anything. However, there is growing financial market clamor to get the Fed off the 0% overnight Bank Lending Rate, so it is possible that they will make this move in sort of a symbolic fashion. But I am not looking for any meaningful short term rate hikes in the first half of 2016, even though the numbers tell us that the economy is firing on all cylinders.

I have been critical of the Fed’s policies in past posts – and how it has led to a malformed recovery. How can we be at full employment and at historically low interest rates? The Fed appears to be no longer data driven, and looking at worldwide soft indicators for guidance. In the words of one Wall Street reporter, the Fed is winging it. And that may be OK, since we are in economic times with no precedent.