I think managing ones own stock portfolio as a non-professional can best be compared to an art rather than a science. Case in point, over the last few months, I have decided to increase my exposure to biotech stocks. When making this decision, the first question I asked myself was – what to I know about biotech stocks? And the answer is very little. So what should I do?

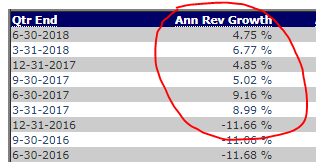

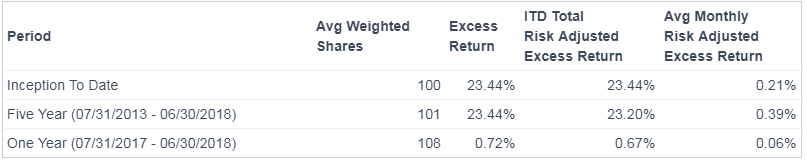

The obvious solution would be to just buy an index fund of biotech stocks. However, before I do that I thought I would try using my timing / momentum model to try to beat the index. In order to do this, my prerequisite is to have a good measurement in place to make sure my strategy is working. So a few months ago, I picked up Bristol Meyers Squibb (BMY) because my model showed it to be attractive on a timing basis, and my model has been reasonably accurate on this stock based on back testing:

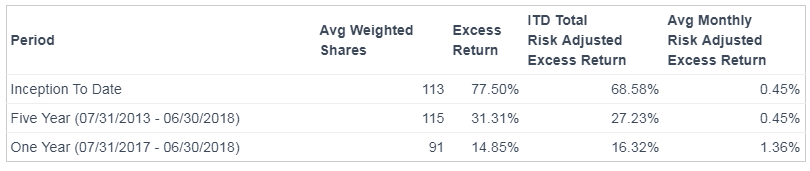

In August my timing model went negative on BMY after it had gone up a bit, so I decided to swap out of it, and swap into Seattle Genetics (SGEN) as my model flagged that stock as attractive. In addition, the model has historically been pretty accurate on SGEN too:

Before investing in SGEN, I reviewed the financials and checked out their product pipeline, but to be honest I can’t say that this information played a big part in my decision. There is no way I can compete with Wall Street on delving into the pipeline and building out revenue models on each drug in the pipeline, and weighing the odds of drug success. So for me, I have to use the timing model, because this fits the one advantage I have. My advantage is I invest such a small amount, I can get in an out of stocks without impacting the stock price. When those Wall Street guys make a decision based on their model, the money they move can really set the price moving against them. My other advantage is if my model is at least as good as right 50% of the time, I will be ahead of the game as I am not paying a .5 % fund expense fee.

I am not necessarily sold on this approach, and may just start buying an index if my performance is underwhelming. After a few months Ithen review the results to see if this strategy looks promising. Assuming this strategy is not a disaster after a few months, I will keep going with it as I don’t like to rely on short term performance to prove or disprove a theory. But sometimes that is all you have.