After a long holding period, I finally dropped Starbucks out of the VFS Invest portflolio. Even though I had to take a capital gain, I decided to remove it because of two reasons. One, given its recent drop on earnings concerns, my momentum model flagged it as under-perform. Two, my thesis for holding Starbucks is crumbling. My main reasons for holding Starbucks was strong management in Howard Schultz, and a good China play. Well, with Schultz leaving, that strikes one reason, as well as introduces another negative I watch. My gut has told me over the years that when a CEO leaves, the stock under-performs for awhile. This may be because the CEO always likes to leave on a high note. Alternatively, this could be because of the turmoil a change in leadership at the top can cause subsequent quarters to underachieve, because of writeoff’s or change in direction of new management.

The second concern is China. I still think China is a huge opportunity for Starbucks long term. Short term, I have a concern about China’s economic performance overall. Given the tariffs and slowing growth in China, I think its conceivable that the long predicted China crash could happen in the next several months, and I would think Starbucks could get hit by this.

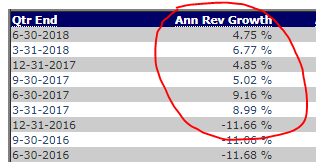

Finally, a third concern is revenue growth is already slowing significantly. Same store comp revenue is now hovering around 2%, and even factoring in revenue from new stores, growth is slowing significantly:

So for now, I am on the sidelines with Starbucks. I just don’t like the risk/reward. I hate selling after a big drop, but I also hate holding a stock because I hope it will go back up. I will watch and wait on the China story, as well as give the new management a couple quarters to prove to me that the leadership is still high quality.