I have always been diligent about looking at past performance of mutual funds prior to investing, and consider it to be one factor when comparing mutual funds. However a recent improvement I made to the VFS Daily Investment contest caused me to look at historical performance in a different light.

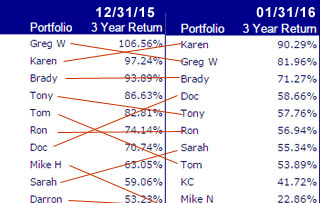

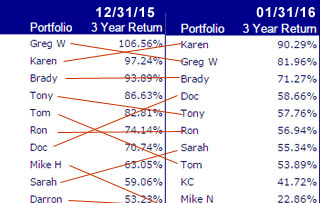

Starting in 2016, I am providing a prize for the portfolio with the best 3 year cumulative return. The purpose was to reward ‘long-term’ excellence, and assumed the top portfolios would be pretty consistent. However, I was surprised when I saw the results for 01/31/16 – the rankings for the top 10 portfolios changed dramatically:

So this caused me to immediately assume my calculations were messed up – so I did a little analysis of the top two portfolios:

| Karen’s Portfolio |

Greg’s Portfolio |

|

| Month |

Monthly Return |

$100 invested

1/1/13 to 12/31/15 |

$100 invested

/1/13 to 1/31/16 |

Monthly Return |

$100 invested

1/1/13 to 12/31/15 |

$100 invested

2/1/13 to 1/31/16 |

| 1/31/2016 |

-3.89% |

|

$ 190.29 |

|

-7.54% |

|

$ 181.96 |

| 12/31/2015 |

2.34% |

$ 197.24 |

$ 197.99 |

|

-4.98% |

$ 206.56 |

$ 196.79 |

| 11/30/2015 |

2.61% |

$ 192.73 |

$ 193.46 |

|

5.99% |

$ 217.37 |

$ 207.09 |

| 10/31/2015 |

19.97% |

$ 187.82 |

$ 188.54 |

|

9.37% |

$ 205.08 |

$ 195.38 |

| 9/30/2015 |

-2.58% |

$ 156.55 |

$ 157.15 |

|

-4.11% |

$ 187.51 |

$ 178.64 |

| 8/31/2015 |

-2.06% |

$ 160.70 |

$ 161.31 |

|

5.02% |

$ 195.56 |

$ 186.31 |

| 7/31/2015 |

8.10% |

$ 164.07 |

$ 164.70 |

|

0.67% |

$ 186.21 |

$ 177.40 |

| 6/30/2015 |

-4.63% |

$ 151.78 |

$ 152.36 |

|

-1.96% |

$ 184.98 |

$ 176.23 |

| 5/31/2015 |

1.59% |

$ 159.16 |

$ 159.76 |

|

4.19% |

$ 188.68 |

$ 179.76 |

| 4/30/2015 |

1.75% |

$ 156.67 |

$ 157.26 |

|

5.40% |

$ 181.09 |

$ 172.53 |

| 3/31/2015 |

-2.02% |

$ 153.98 |

$ 154.56 |

|

-0.89% |

$ 171.82 |

$ 163.70 |

| 2/28/2015 |

7.40% |

$ 157.15 |

$ 157.75 |

|

5.35% |

$ 173.36 |

$ 165.16 |

| 1/31/2015 |

-1.26% |

$ 146.32 |

$ 146.88 |

|

7.62% |

$ 164.55 |

$ 156.77 |

| 12/31/2014 |

-3.65% |

$ 148.19 |

$ 148.75 |

|

-2.65% |

$ 152.90 |

$ 145.68 |

| 11/30/2014 |

2.77% |

$ 153.80 |

$ 154.39 |

|

2.32% |

$ 157.06 |

$ 149.64 |

| 10/31/2014 |

5.12% |

$ 149.65 |

$ 150.22 |

|

0.23% |

$ 153.50 |

$ 146.24 |

| 9/30/2014 |

-2.45% |

$ 142.36 |

$ 142.90 |

|

-1.79% |

$ 153.15 |

$ 145.91 |

| 8/31/2014 |

1.93% |

$ 145.94 |

$ 146.49 |

|

4.60% |

$ 155.94 |

$ 148.57 |

| 7/31/2014 |

1.37% |

$ 143.17 |

$ 143.71 |

|

-1.79% |

$ 149.08 |

$ 142.03 |

| 6/30/2014 |

0.65% |

$ 141.24 |

$ 141.77 |

|

3.03% |

$ 151.80 |

$ 144.62 |

| 5/31/2014 |

5.11% |

$ 140.32 |

$ 140.85 |

|

6.09% |

$ 147.34 |

$ 140.37 |

| 4/30/2014 |

-0.33% |

$ 133.50 |

$ 134.01 |

|

-0.15% |

$ 138.87 |

$ 132.31 |

| 3/31/2014 |

-0.98% |

$ 133.95 |

$ 134.46 |

|

-3.44% |

$ 139.09 |

$ 132.51 |

| 2/28/2014 |

6.70% |

$ 135.27 |

$ 135.78 |

|

4.00% |

$ 144.04 |

$ 137.23 |

| 1/31/2014 |

-2.99% |

$ 126.78 |

$ 127.26 |

|

-1.80% |

$ 138.50 |

$ 131.95 |

| 12/31/2013 |

2.63% |

$ 130.69 |

$ 131.18 |

|

4.74% |

$ 141.04 |

$ 134.37 |

| 11/30/2013 |

2.86% |

$ 127.34 |

$ 127.82 |

|

3.31% |

$ 134.65 |

$ 128.29 |

| 10/31/2013 |

9.14% |

$ 123.80 |

$ 124.27 |

|

7.58% |

$ 130.34 |

$ 124.18 |

| 9/30/2013 |

0.90% |

$ 113.43 |

$ 113.86 |

|

5.08% |

$ 121.16 |

$ 115.44 |

| 8/31/2013 |

-1.22% |

$ 112.42 |

$ 112.84 |

|

-1.51% |

$ 115.31 |

$ 109.86 |

| 7/31/2013 |

4.78% |

$ 113.81 |

$ 114.24 |

|

9.06% |

$ 117.07 |

$ 111.54 |

| 6/30/2013 |

-1.71% |

$ 108.61 |

$ 109.02 |

|

0.24% |

$ 107.35 |

$ 102.27 |

| 5/31/2013 |

1.48% |

$ 110.50 |

$ 110.92 |

|

1.08% |

$ 107.09 |

$ 102.02 |

| 4/30/2013 |

3.26% |

$ 108.89 |

$ 109.30 |

|

1.44% |

$ 105.94 |

$ 100.93 |

| 3/31/2013 |

2.90% |

$ 105.45 |

$ 105.85 |

|

2.15% |

$ 104.44 |

$ 99.50 |

| 2/28/2013 |

2.87% |

$ 102.48 |

$ 102.87 |

|

-2.60% |

$ 102.23 |

$ 97.40 |

| 1/31/2013 |

-0.38% |

$ 99.62 |

|

|

4.96% |

$ 104.96 |

|

And I found my explanation. Using the approach of measuring return in terms of ‘$100 invested 3 years ago now is worth x’ does really magnify recent performance. Note that even though Gregs portfolio was down 7.5% in January, it knocked $15 off his hypothetical investment. So losses for the leaders are magnified as they hypothetically have more assets to lose.

The other important point is the starting point makes a big difference. Greg’s portfolio for the period 2/1/13 – 01/31/16 got hurt, because he had a decent month in January (highlighted in green), which no longer counted. Removing the 4% gain from the first month knocked $10 off the 3 year return, further causing the large drop in Greg’s portfolio’s value.

So the moral to the story? Be careful when looking at mutual fund past performance – as the time period you are looking at may make a big difference in how the performance is measured. Or better yet – maybe mutual fund expense ratio is a much better indicator of future fund performance, since past performance is a pretty fluid measurement.