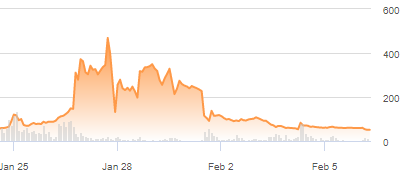

Lots has been written about the recent eruption of Gamestop stock as part of the Reddit rally against the big money on Wall Street, but I thought I would do a quick post just to sum up my thoughts. As you may recall, Gamestock stock went up 1000% after a Reddit Wall Street bets board focused small retail investors to buy Gamestop because it was shorted 140%.

I think the initial strategy was correct – I think the fact that GME was shorted 140% was a mistake by the big money algorithm that failed to take that into account. When the reddit member who spotted that and spurred others via the forum to buy the stock was a creative way to profit off that mistake. I think those that got in on the first few days of the price move did pretty well. However, I think most the money that was made after January 26th was made by the big money hedge funds that the reddit movement was looking to punish.

A lot of the sentiment by the retail buyers was driven by hatred of the big money on wall street, and the feeling that the market is rigged against the small investor. To that point, I think it was a success. I think this exposed some tricks the big money used to kill the movement. While maybe Robinhood (the retail broker at the center of this) did have some fiscal reason to prevent traders on its platform from buying Gamestop stock during the heights of this movement, I find it hard to believe the big money behind Robinhood did not put pressure on the broker to keep retail investors from squeezing the shorts. This also brought to light the trade ‘front-running’ which pays for the ‘no-commission’ trades. When you trade a stock on a no-commission basis, it is clear the money is made up by the clearing house not giving you the best price. I also believe the expansion of the Gamestop trade to target other shorted stocks and silver was a deliberate diversion from the Gamestop movement.

The biggest fault I have with this is that it was driven by emotion. This anger at the big money should not of let investors to ignore basic stock fundamentals. One of the earliest lessons I learned (and keep trying not to repeat) is ‘don’t fall in love with a stock’. The mantra of ‘hold at all costs’ on Reddit is a failed strategy. This emotion is what let to all the small investors who joined the movement late to give their money to the hedge funds who know more about price fundamentals. While I don’t disagree with the sentiment on Reddit, I don’t think having thousands of small investors lose money on an irrational trade is the best response.

So that’s my take. I am heartened to see the younger generations take up these activist positions, and perhaps some good ideas came of this event. And I hope these small investors learned a little about mixing emotions with investing, and how important it is in most cases to keep them separated.