Note – Post updated on 4/27/19 – see below.

The other day I was looking over my portfolio to make changes based on what my valuation model suggested. One of the stocks in my top 10 holdings, Universal Forest Products, Inc (UFPI), came up as a stock to underweight based on relative valuation. UFPI is a pretty inexpensive, low growth stock, and it had a small run in the last few months.

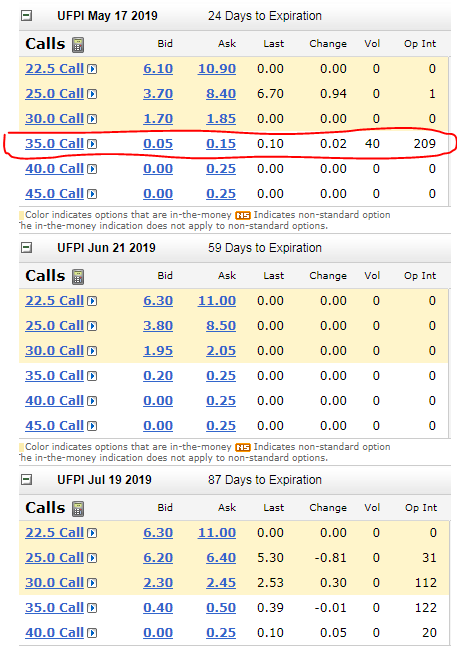

As I often do with stocks in which I have a short term gain, I give some pause to selling. My model predicted a .44% increase in May, so its not like I was bearish on the stock, just thought there might be better alternatives in other securities. So I took a quick look to see if it might make sense to sell a covered call against my position, collect some extra income since I don’t think the stock is going to move much in May. So I pulled up the options chain, and saw an interesting tidbit:

It is interesting to see that the volume on most UFPI options is zero. This is a small 1.89 billion market cap stock, not followed by many people. But curiously, in this list of zero options, someone tossed down a 40 contract trade betting that the stock would go from its current price ($31) to over $35 by May 17th. Granted that is only a $400 investment (40 contracts @ $.10 * 100 shrs a contract), so this isn’t likely the so called ‘smart money’, but it is curious. UFPI releases earnings tomorrow (April 24th) after the bell – perhaps some small roller is ‘playing a hunch’ and trying to earn some extra cash.

At any rate, this raised my curiosity enough for me to hold onto my position until after the earnings release. I am not in any big hurry to sell, and maybe this is telegraphing some good news around the corner.

4/27/19 Update

Earnings came out more positive than expected, pushing the share price from around $30 to a $36.65 close on Friday. those options purchased for $0.10 are now worth approximately $1.90. That $400 option investment translates to a current value of $7,600. So it appears that if you are going to sell a stock, it may be worth always check the options trades to see if anybody might be making a big bet.