Anybody who has invested in emerging markets over the last few years will tell you they have been killed. Investing in emerging markets has been a small part of my diversification strategy, so while it has not been a winner I see it as a cost of diversification.

So I was interested to see this article discuss the BRICs (acryonym for Brazil, Russia, India, China) – and how they have been turning around – and this chart tells an interesting story:

While the point of this article is that India is the winner so far in emerging markets investments, the recent uptick in the other BRICs was what interested me. Yes I think India is an interesting investment opportunity – but so does everybody else and thus its pretty high priced compared to other companies.

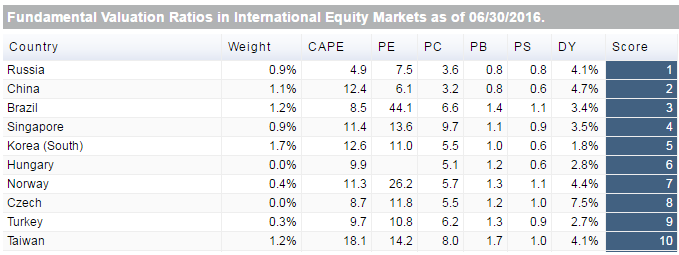

One of the other sites I check in periodically is this Star Capital page showing worldwide market valuations.

Note Russia, China and Brazil are the 3 cheapest equity markets in the world using this sites scoring system (which seems fair). India is not shown – as it appear at #32 right ahead of the US at #33.

Yes Russia, China, and Brazil all have their warts and reasons not to invest in those markets – but the valuations when compared to India are intriguing. For contrarians who believe the uptick of emerging markets is not just a blip but a trend, one would have to think there is an opportunity here.